What exactly defines a person's worth? Is it purely a numerical value, a tally of assets and liabilities? Perhaps, but truly understanding a person's financial standing involves much more than a simple calculation; it requires understanding their influence, their contributions, and the complexities of their financial life.

At its most basic, an individual's net worth is the sum of their assets minus their liabilities. Assets encompass everything from real estate holdings and diverse investment portfolios to personal property and liquid cash. Liabilities, on the other hand, include debts, loans, and other financial obligations. While conceptually straightforward, determining the precise net worth of any individual, especially one with complex holdings, is a challenge, often requiring access to detailed financial records that are rarely, if ever, publicly available. Therefore, any public estimations should always be approached with a degree of skepticism, recognizing they are often rooted in speculation or incomplete information.

| Category | Details |

|---|---|

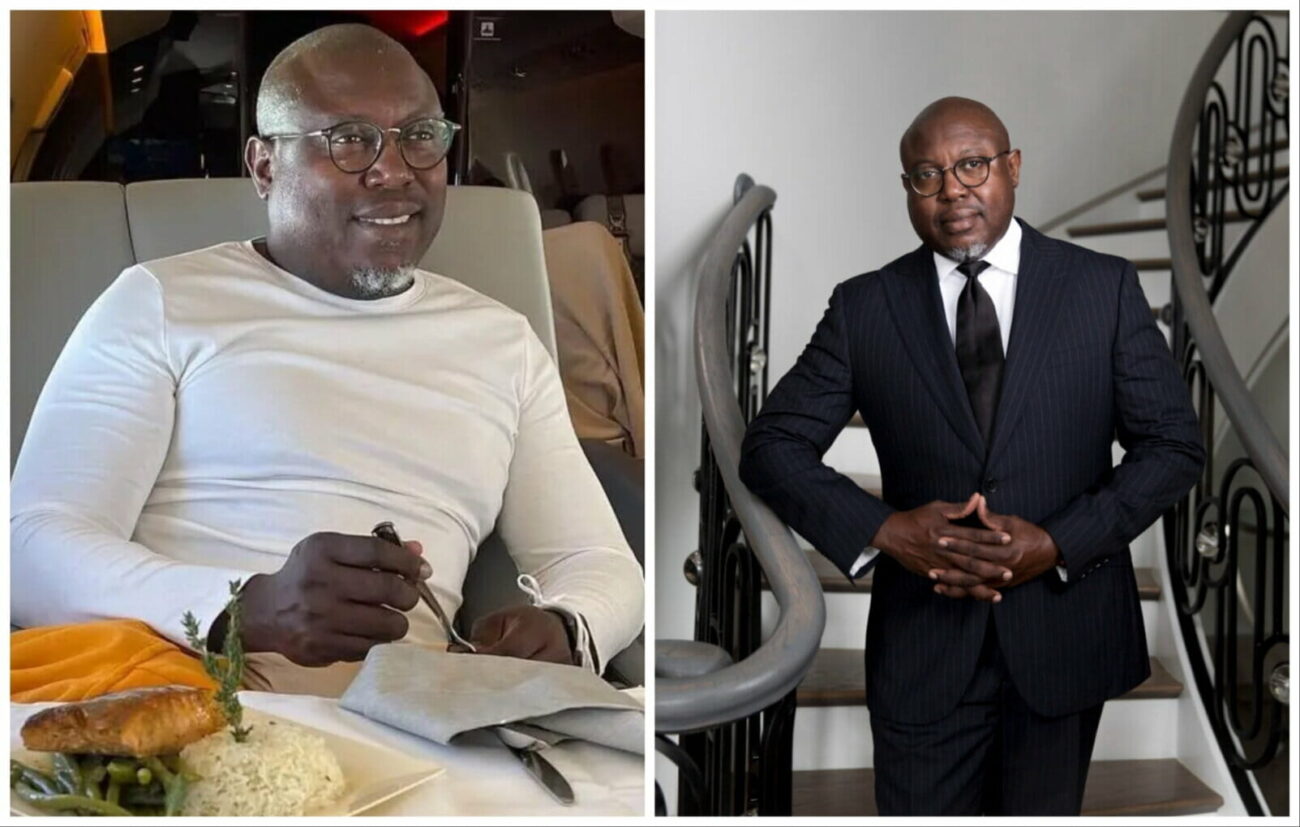

| Name | Simon Guobadia |

| Occupation | Entrepreneur, Film Producer, Investor |

| Known For | Founder of SIMCOL Petroleum Limited Company, Film Producer, Starred in The Real Housewives of Atlanta |

| Public Profile | High visibility through reality television appearances, social media presence, and business ventures. |

| Birthdate | (Date of birth if known) |

| Place of Birth | Nigeria |

| Spouse | Porsha Williams (engaged) |

| Company | SIMCOL Petroleum Limited Company |

| Authentic website For Reference | SIMCOL Petroleum Limited Company |

While a definitive figure may be beyond reach, attempting to assess Simon Guobadia's financial position, even through estimations, can provide valuable insights into his career trajectory, professional achievements, and overall influence. This process involves piecing together information from various sources and acknowledging the inherent limitations. The opaqueness surrounding Guobadia's exact net worth is not uncommon; many high-profile individuals choose to maintain a degree of financial privacy. Furthermore, the sheer complexity of calculating assets and liabilities, particularly those tied to private holdings and investments, can make accurate public reporting virtually impossible.

- Decoding Hank Voight A Deep Dive Into Law Enforcement Ethics Now

- Explore Gosford Park Filming Locations Map A Visual Guide

The following will dissect the intricacies and constraints involved in approximating Guobadia's net worth. In the absence of precise financial statements, we will explore his professional background, business ventures, and public engagements, all of which contribute to a broader understanding of his financial standing. This approach is not about arriving at a definitive number but rather about appreciating the layers of information and the challenges of financial assessment in the public sphere.

Estimating an individual's financial standing is a multifaceted endeavor. It requires a deep dive into various elements, each contributing to a more comprehensive understanding of overall wealth. These elements include not only easily quantifiable assets and liabilities but also more nuanced aspects such as income streams, investment strategies, public image, financial transparency, and industry influence.

The cornerstone of any net worth assessment lies in understanding an individual's assets. This includes tangible possessions like real estate and personal property, as well as intangible assets such as investments and intellectual property. Simultaneously, a thorough evaluation of liabilities is essential. This involves scrutinizing outstanding debts, loans, and other financial obligations that offset asset values. Income streams provide context for evaluating an individual's earning capacity and ability to accumulate wealth over time. Investment strategies reveal how effectively an individual manages capital and navigates financial markets. A prominent public profile, while not a direct indicator of net worth, can suggest access to resources and opportunities. Financial transparency, or the lack thereof, affects public perception and the ease with which financial claims can be verified. Finally, industry standing can influence an individual's earning potential and access to exclusive opportunities. Attempting to estimate net worth without considering all these factors can lead to misleading conclusions. Therefore, caution is paramount when interpreting publicly available figures, many of which are based on incomplete data or speculation.

- Why P Diddy Eminem Collab Never Happened And Its Impact

- Unlock How Old Was Liam Payne On X Factor Career Impact

Assets, in essence, represent an individual's accumulated resources and holdings. Their value is paramount in the calculation of net worth. For someone like Simon Guobadia, understanding the nature and extent of these assets is crucial for building a realistic picture of his financial position. The composition of these holdings provides insights into his financial success, resource allocation strategies, and investment acumen.

- Real Estate Holdings

Real estate, encompassing properties and land, often constitutes a substantial portion of an individual's net worth. The value of these holdings is contingent on location, condition, and prevailing market dynamics. Analyzing potential real estate assets provides a framework for understanding the financial underpinnings of an individual's wealth. Furthermore, the volatility of real estate markets means that fluctuations in property values directly impact overall net worth estimations. Real estate portfolios can range from residential properties to commercial ventures, each presenting unique valuation challenges and contributing differently to overall financial standing.

- Investment Portfolios

Investments in stocks, bonds, mutual funds, and other financial instruments represent another critical component of an individual's asset base. The diversity and performance of these investments are significant determinants of overall asset value. Returns on investments, coupled with associated risk factors, directly affect net worth. Moreover, a person's investment strategy whether conservative, aggressive, or somewhere in between provides insight into their approach to wealth management. Analyzing past investment performance and potential strategies can offer clues about the overall health and growth potential of an individual's assets. A well-managed investment portfolio can serve as a powerful engine for wealth creation, while a poorly managed one can erode financial stability.

- Liquid Assets

Liquid assets, including cash, savings accounts, and easily convertible investments, play a crucial role in ensuring financial flexibility and immediate access to funds. The availability of these assets affects an individual's ability to meet short-term obligations and capitalize on immediate opportunities. Robust cash reserves and readily accessible funds contribute to a sense of financial security and stability. Moreover, liquid assets provide a buffer against unforeseen financial emergencies and offer the flexibility to pursue new ventures without incurring significant debt.

- Other Assets

The category of "other assets" encompasses a wide range of possessions, including personal property such as vehicles and art collections, as well as intellectual property like patents and copyrights. These assets contribute to the overall net worth calculation, although their valuation can be complex and subjective. The value of personal property often depends on market conditions, rarity, and individual circumstances. Intellectual property, on the other hand, can generate significant income streams but also requires ongoing management and protection. Accurately valuing these diverse assets often necessitates appraisals, market estimations, and a deep understanding of specific market niches.

Gaining a holistic understanding of the types, quantities, and values of assets held by an individual is paramount when assessing their financial standing. While detailed information about Simon Guobadia's assets is not publicly available, considering these diverse categories provides critical context for evaluating his potential net worth within the broader financial landscape. The ability to strategically accumulate and manage assets is a hallmark of financial success, and understanding the composition of an individual's asset portfolio is key to assessing their overall financial health.

Liabilities are the flip side of the asset coin, representing an individual's financial obligations and debts. These obligations directly reduce net worth, making their assessment essential for a complete financial picture. Outstanding debts, loans, and other commitments subtract from available assets, impacting an individual's overall financial health. The magnitude and nature of these liabilities provide crucial context for evaluating financial stability and solvency. An individual's ability to effectively manage liabilities directly impacts their long-term financial prospects.

- Loans and Debts

Loans, mortgages, and personal debts represent significant liabilities for many individuals. Outstanding loan balances directly diminish net worth, and the terms of these obligations, including interest rates and repayment schedules, impact the overall financial burden. High-interest loans and substantial debt obligations can create considerable financial strain, limiting an individual's ability to invest and accumulate assets. Effectively managing loan portfolios and minimizing debt are critical for maintaining a healthy financial profile. The judicious use of debt can fuel growth, but excessive or poorly managed debt can jeopardize financial stability.

- Outstanding Taxes and Fees

Unpaid taxes, penalties, and other financial obligations to governmental entities constitute liabilities that can significantly impact net worth. These obligations often arise from various sources, including income tax, property tax, and regulatory fees. Failure to meet these financial responsibilities can lead to further penalties, legal action, and a diminished financial standing. Proactive tax planning and compliance are essential for avoiding these liabilities and maintaining a positive financial trajectory. Overdue taxes can quickly escalate due to interest and penalties, making timely payment crucial.

- Guarantees and Commitments

Guarantees and commitments made on behalf of others represent potential future liabilities. By co-signing loans or providing financial guarantees, individuals expose themselves to the risk of assuming responsibility for the debts or obligations of others. Unforeseen events or circumstances may necessitate fulfilling these obligations, impacting available resources and reducing net worth. Carefully evaluating the risks associated with guarantees and ensuring that these commitments align with personal financial capabilities is essential for managing personal finances effectively.

- Financial Obligations and Contingencies

Contingent liabilities, which depend on future events, add complexity to net worth calculations. These potential obligations may arise from ongoing legal proceedings, product warranties, or other contractual agreements. Accurately forecasting these contingent liabilities is crucial for estimating the true extent of an individual's financial obligations. The potential impact of these future obligations should be factored into financial planning and risk management strategies. Failure to anticipate and account for contingent liabilities can lead to unexpected financial strain.

A thorough assessment of liabilities is paramount for evaluating an individual's overall financial position. Understanding the nature and extent of financial obligations provides essential context for evaluating net worth and overall financial health. A comprehensive understanding of an individual's liabilities enhances the accuracy of net worth estimations and provides insights into potential financial vulnerabilities.

Income sources are the lifeblood of financial well-being and a fundamental component in understanding net worth. The nature, stability, and volume of income directly influence an individual's capacity to accumulate assets and build wealth. Higher and more consistent income streams generally correlate with a greater capacity to invest, save, and acquire assets, leading to a higher net worth. Conversely, limited or unstable income streams often restrict asset accumulation and make it challenging to maintain a positive financial trajectory.

The composition of income sources is also crucial. A diversified income stream, encompassing salary, investments, business profits, and other revenue sources, provides a more robust and sustainable financial foundation. Relying solely on a single income source can expose an individual to greater financial risk, as job loss or business downturns can significantly impact their overall financial standing. The stability and reliability of income are critical in the context of long-term wealth building and maintaining a positive net worth. Individuals with diversified and stable income streams are better positioned to weather economic storms and achieve their financial goals.

Examining income sources provides valuable context for understanding net worth. For example, an individual with substantial income from a high-paying employment and a robust investment portfolio is likely to have a significantly higher net worth than someone earning a modest salary with minimal investment returns. Consider a professional athlete, whose income fluctuates based on performance and contract terms. Their net worth can be highly dependent on short-term income surges and long-term contract stability. Similarly, an entrepreneur's income hinges on the success of their business ventures; their fluctuating income directly impacts their net worth, making it a dynamic figure tied to the fortunes of their enterprise. Understanding the types and sources of income allows for a more nuanced and accurate evaluation of overall financial health.

Investment strategies play a pivotal role in shaping an individual's net worth. The decisions made in managing capital through investments directly affect the accumulation, preservation, and growth of wealth. These decisions, often guided by factors such as risk tolerance, time horizons, and financial goals, have a profound impact on long-term financial outcomes. Understanding the interplay between investment strategies and net worth is crucial for evaluating the financial standing of individuals.

- Risk Tolerance and Diversification

Investment strategies often reflect an individual's willingness to accept potential losses in pursuit of higher returns. A high-risk strategy, focusing on potentially higher-reward investments, might lead to significant gains but also exposes the investor to substantial losses. Conversely, a low-risk strategy, emphasizing security and stability, could result in more modest returns but offers greater protection against market volatility. Diversification across asset classes, such as stocks, bonds, and real estate, can help mitigate risk by reducing dependence on any single market. Implementing diverse investment strategies is crucial for long-term wealth management, as it balances the potential for growth with the need for capital preservation. A well-diversified portfolio can weather economic downturns and provide a more stable foundation for long-term financial success.

- Time Horizon and Financial Goals

Investment strategies are typically tailored to an individual's time horizon and financial objectives. A long-term investor focused on retirement savings might employ strategies aimed at growth and long-term capital appreciation. This approach often involves investing in equities and other assets with higher growth potential but also greater volatility. A shorter-term investor with a specific goal, like a down payment on a house, may prioritize strategies focused on preserving capital and generating predictable returns. This may involve investing in bonds or other low-risk assets. Investment choices aligned with individual financial goals are critical for achieving desired outcomes. A mismatch between investment strategy and financial goals can lead to suboptimal returns and increased financial risk.

- Investment Portfolio Allocation

The allocation of capital across different investments significantly influences portfolio performance. Strategies vary based on perceived market opportunities, anticipated returns, and risk tolerance. A well-diversified portfolio can balance risk and reward to maximize potential gains while minimizing losses. The specific allocation should reflect an individual's financial goals, time horizon, and risk appetite. Rebalancing the portfolio periodically to maintain the desired allocation is essential for managing risk and maximizing returns. Strategic allocation of resources is critical for achieving long-term financial goals.

- Market Trends and Economic Conditions

Market conditions and economic trends play a major role in the success or failure of investment strategies. Adapting to changing market dynamics and adjusting investment strategies accordingly is crucial for maintaining a well-performing portfolio. Successful investors continuously monitor market trends, economic indicators, and geopolitical events to identify opportunities and mitigate risks. They are also willing to adjust their strategies based on changing market conditions. A dynamic and adaptive approach to investment management is essential for navigating the complexities of financial markets.

An individual's public profile, encompassing their visibility and activities in public life, can indirectly influence perceptions of their net worth. While not a direct measure, a prominent presence often suggests access to resources and opportunities that might contribute to substantial financial standing. This relationship, however, is complex and indirect, relying on the interpretation of public actions and associated implications. Furthermore, a lack of public presence does not inherently diminish financial standing. Many wealthy individuals prefer to maintain a low profile.

- Public Recognition and Achievements

Notable achievements, awards, and public recognition can be associated with significant financial success, although the causal link is not always apparent. The scale and nature of recognition, like prestigious awards or high-profile positions, can suggest considerable financial resources or influence, but this is not always a direct correlation. Public prominence in philanthropic work, for instance, might indicate substantial wealth, but it could also reflect a commitment to social responsibility regardless of net worth.

- Professional Affiliations and Activities

A prominent role within an influential industry or participation in high-profile projects can suggest access to substantial resources and a capacity for financial gain. Leadership positions or participation in notable organizations might indicate involvement in activities with substantial financial implications. However, the connection between professional standing and financial worth is not deterministic. A prominent individual might hold a position for reputational reasons rather than purely financial ones.

- Media Coverage and Public Image

Extensive media coverage can raise an individual's public profile, increasing awareness of their activities and potentially associated financial standing. The portrayal of lifestyle, philanthropic efforts, or acquisition of assets in the media can influence perceptions of wealth. However, media portrayals should be carefully considered, as depictions of wealth might be intentionally enhanced, inaccurate, or contextualized for journalistic purposes. Media reports should not be directly used to assess precise net worth.

- Philanthropic Activities and Investments

Publicly disclosed philanthropic activities and investment commitments can serve as indirect indicators of an individual's financial standing. Contributions to significant charities or ventures could imply substantial financial resources. Transparency in philanthropy might correlate with greater financial capacity and, therefore, potential net worth. Nevertheless, public statements regarding philanthropy should be considered alongside other evidence to avoid misinterpretation. The scale and nature of philanthropic activities should be carefully evaluated.

Financial transparency, the open disclosure of financial information, plays a significant role in shaping public perception of an individual's financial standing. A lack of publicly available financial data complicates estimations of net worth. Transparency, or its absence, influences how the public interprets reported achievements, professional success, and overall financial position.

- Public Disclosure of Financial Information

Public disclosure of financial information, such as through financial statements or tax filings, allows for a more informed assessment of an individual's financial health. This form of transparency allows for independent verification of stated information about financial success and standing. Without this public disclosure, estimations of net worth often rely on conjecture, interpretation, or incomplete data. In the absence of direct disclosure, any published figure regarding net worth must be treated with extreme caution, considering the potential for inaccuracies or exaggerations.

- Impact on Credibility and Trustworthiness

Transparency in financial dealings directly impacts an individual's credibility and trustworthiness. Public disclosure fosters confidence and reduces suspicion. Conversely, a lack of transparency might raise concerns about the accuracy or completeness of publicly stated information regarding financial standing. This often results in public skepticism and a greater degree of difficulty in objectively assessing reported financial data.

- Relationship to Public Perception and Reputation

Financial transparency significantly affects public perception and reputation. Open financial dealings instill public trust and support. Conversely, a lack of transparency can generate suspicion and potentially damage an individual's standing, both professionally and socially. Public perception is influenced by the degree to which financial dealings are accessible.

- Effect on Investment Decisions and Market Confidence

In investment and financial markets, transparency is essential for maintaining confidence and trust. The absence of transparency can lead to uncertainty and skepticism, potentially hindering market confidence and affecting investment decisions. This is especially crucial in professional contexts where financial health directly affects the public. Public trust regarding financial dealings is essential for sustained market confidence. Any lack of transparency may impact market reactions to activities.

Industry influence is a factor that can significantly impact an individual's financial standing. A prominent role within a lucrative industry often correlates with access to resources, opportunities, and potentially substantial financial gain. The degree of influence within an industry can, in turn, affect an individual's net worth.

- Position and Power Dynamics

A high-ranking position within a particular industry often grants access to valuable resources and decision-making power. Individuals in influential leadership roles may command higher compensation packages, have access to exclusive investment opportunities, and wield significant leverage in negotiating favorable terms. This, in turn, directly affects the accumulation of assets and thus contributes to a higher net worth. Examples include CEOs of major corporations, who influence their company's financial performance and thus their own wealth.

- Industry Expertise and Reputation

Deep industry expertise and a strong reputation can generate significant demand for an individual's skills and services. Consultants, professionals, or innovators with specialized knowledge often command higher fees and potentially access to a wider range of lucrative opportunities. Their ability to solve problems or offer innovative solutions can create substantial value, which directly impacts their net worth.

- Networking and Connections

Strong industry networks and connections are frequently valuable assets. Individuals with extensive networks can access opportunities, capital, and information unavailable to those outside their network. These connections often facilitate collaborations, funding, or mentorship, potentially leading to better financial outcomes. This is particularly relevant in industries where relationships and connections are crucial for success.

- Influence on Market Trends and Pricing

Individuals with substantial influence within an industry can impact market trends and pricing. Their opinions, decisions, or actions can shape market behavior, potentially impacting the demand for and profitability of products or services. This influence directly affects the overall success and financial standing of the industry, and individuals prominent within it benefit accordingly. A well-known figure in a particular industry, for example, may be able to command higher fees or licensing fees.

Estimating an individual's net worth, especially without publicly available financial records, requires careful consideration. The following addresses common inquiries.

Question 1: What is Simon Guobadia's net worth?

Precise figures are not publicly available. Estimates vary significantly and should be treated with caution. Calculating net worth requires detailed financial records, often unavailable to the public.

Question 2: Why is precise net worth information unavailable?

Several factors contribute to the lack of publicly available data. Individuals may choose to maintain privacy. Complex calculations involving evaluating assets and liabilities can also hinder public dissemination. Lack of proactive disclosure is common for many individuals.

Question 3: What factors influence estimations of net worth?

Various factors inform estimations, although they do not constitute a definitive measurement. These include: the individual's occupation, career trajectory, industry standing, publicly known investments, philanthropic activities, and professional achievements. Analysis of these elements provides context, but these are still not definitive measures. Estimates are often not precise and are based on incomplete evidence.

Question 4: How should public estimates of net worth be approached?

Public estimations should be approached with caution. Such figures are frequently based on incomplete information and require careful review before acceptance. The absence of official declarations regarding financial details should not be misconstrued as a definitive statement about someone's wealth. Consideration of other data points is essential.

Question 5: What is the significance of discussing Simon Guobadia's financial standing, if precise figures are unavailable?

Discussion, despite lack of precise figures, is important for understanding how factors like career, industry influence, and public activities can contribute to an individual's overall standing. While precise net worth remains unavailable, context surrounding the individual's position adds value to financial analysis.

In summary, precise net worth figures are not readily available. Estimating net worth requires careful consideration of multiple factors, and public estimates should be approached with caution. The absence of definitive data necessitates reliance on context.

The following sections will further explore the complexities of estimating wealth and the interplay of factors contributing to the perception of financial standing.

Assessing Simon Guobadia's net worth presents significant challenges due to the absence of publicly available financial data. This article explored the multifaceted nature of such estimations, highlighting the intricate interplay of various factors. Analysis encompassed an individual's assets, liabilities, income sources, investment strategies, public profile, financial transparency, and industry influence. While a precise figure remains elusive, the exploration illuminated the complexities inherent in calculating and understanding wealth, underscoring the limitations of relying solely on publicly accessible information. The absence of definitive data necessitates a cautious approach when interpreting estimates and emphasizes the importance of considering the various factors contributing to overall financial standing.

The absence of readily available data concerning Simon Guobadia's financial situation does not diminish the importance of examining the contextual elements that might impact perceptions of wealth. The analysis of occupation, industry presence, and public profile, while not direct measures of net worth, offers valuable insight into an individual's position within the financial and societal landscape. This analysis emphasizes the need for critical evaluation and a comprehensive understanding of the factors that contribute to a complete picture of financial standing. Further research into accessible public information, including Simon Guobadia's professional activities and public engagements, may shed additional light on his influence and potential financial standing, though definitive answers may remain elusive.

- Decoding Johnny Gills Relationships A Look At Public Perception Amp Impact

- Spotlight On Zoe Perrys Children The Price Amp Joy Of Fame